how to set up a payment plan for california state taxes

Pay through Direct Debit automatic monthly payments from your checking account also known as a Direct Debit Installment Agreement DDIA. Make sure all previous returns are filed.

When Will You Get Your Inflation Relief Check California Announces New Dates For Debit Cards

It may take up to 60 days to process your request.

. Individual taxpayers who owe up to 25000 to the California FTB Franchise Tax Board can pay in monthly installments for up. If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. Your payment options depend on your total tax liability.

The state typically gives a taxpayer three to five years to pay off a balance once a California state income tax payment plan has been granted. The taxpayer must agree to the following Taxpayer Installment Agreement Conditions while in an Installment Agreement. Processing the application takes 90 days and costs 34 for individuals and 50 for businesses.

The State of California has provided access to payment plans. Individual taxpayers and businesses can apply for instalment plan agreements from the FTB. If you are aware of any balances that are not in collections please complete the REV-638 to have the amounts.

How to set up a. BEFORE SETTING UP A PLAN. You dont have to write another check to pay your individual tax payment agreement if you dont want to.

Typically taxpayers are given three to five years by the state to pay off a balance once a California tax payment plan has been granted. Pay a 34 set-up fee that the FTB adds to the balance due. As an individual youll.

Keep enough money in. With the State of Maryland recurring direct debit program you. Pay a 34 setup fee that will be added to my balance due.

Individual taxpayers need to pay a. To do so you will need to file Form 9465 Installment Agreement Request and Form 433-F Collection Information Statement. Make monthly payments until my tax bill is paid in full.

Pay by automatic withdrawal from my bank account. How to set up a payment plan with the state of California.

Oceanside News Oceanside Chamber Of Commerce

Gop S Faulconer Pitches Income Tax Cut Plan For California

Stripe Tax Automate Tax Collection On Your Stripe Transactions

Secured Property Taxes Treasurer Tax Collector

Surplus In Hand California Governor Proposes Tax Cuts Expanded Health Care Cbs8 Com

California Inflation Relief Checks

California Plans To Double Taxes Get Your Plan B Now Htj Tax

Some Seniors Disabled People Won T Get California Gas Rebate Calmatters

Newsom S Plan California S Middle Class Taxpayers Could Get A Rebate Under Proposal The New York Times

Tax Payment Plans What To Know If You Can T Pay Your Taxes

California Stimulus Check 2022 Do You Qualify

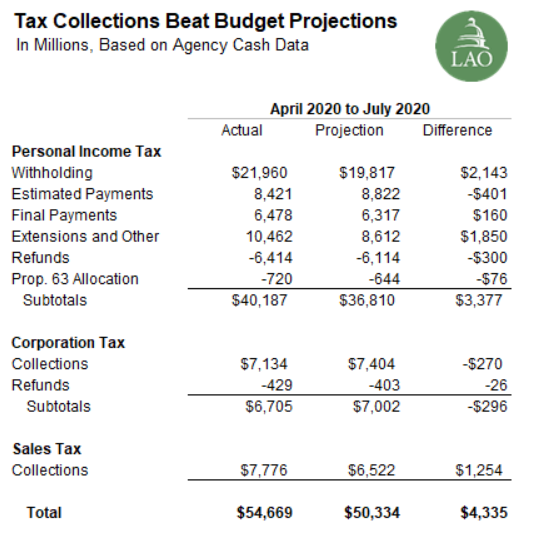

State Tax Collections Update April 2020 To July 2020 Econtax Blog

Christopher Keleshyan Mba Posted On Linkedin

State Accepts Payment Plan In San Jose Ca 20 20 Tax Resolution

Making Electronic Estimated Tax Payments In California Robert Hall Associates

Where S My Refund California H R Block

Kusi News Under Joe Biden S Proposed Tax Plan The Top Tax Rates In California And New York City Would Be 62 Biden Has Also Promised To Repeal The Trump Tax Cuts